1. Portfolio Value and Net Worth as it stood at the end of the previous month

2. Income, Expenses and Savings achieved for the previous month

3. My Investing Choice for the previous month's savings

This post covers point 2 above: Income, Expenses and Savings achieved.

Income - Mar 2016

This is likely to be the last month I'll benefit from cashback for my direct debits from the Santander 1|2|3 account* (£12.10), because I'm changing banks in order that money in my current account can be offset against our new mortgage as we move house.

It's another nice month for interest at £37.53 which is due to the fact that I had the profit from my flat sale sat in my account until it was transferred to my ISA.

Income was further supplemented by an expense that I'd previously forgotten to withdraw from my Company account to cover costs associated with office working from home (£208). I also sold my fitbit on Ebay in February and withdrew the money from my Paypal account in March.

My monthly income target (as noted in my FIRE Targets for 2016) is set at £3,332 per month, which I've easily managed to achieve with £256.30 to spare - mostly thanks to the business expense repayment.

* The Santander 1|2|3 account offers 3% AER (variable) interest when the balance on the account is above £3,000 (on balances up to £20,000) as well as cash back for selected monthly direct debits (1% for water, council tax and Santander mortgage; 2% for gas & electricity; 3% for mobile, phone, tv & broadband). More details and the terms and conditions about the product are available on the Santander website. This is not a referral or affiliate link, this is provided purely for information purposes only.

Expenses - Mar 2016

Points of note this month:

- No council tax again because it's paid over 10 months rather than 12 by direct debit (not sure why, Councils seem to work it out this way for some reason)

- I needed to pay the garage to fix and replace some of the wheel bolts on my car this month - I discovered they'd gone bad when I took my car to have the tyre replaced due to a flat a couple of months ago, this is exactly the sort of thing my Savings Stash is for (phew!)

- My grocery bill was about £100 more in March than I spent in February, I need to keep an eye on this moving forward - it would be nice to try to keep this cost down a bit if I can. Part of the reason for the extra cost was because I hosted a Ladies Dinner and Film evening at mine, this is a monthly thing I do with 4 of my family/friends, so every 5-6 months it's my turn to host

- March was a busier month for me entertainment wise, we took Mum out for a nice Mother's Day lunch, I had a trip to Cardiff visiting a friend and I went out for St. Patrick's Day with friends

- My Savings Stash covers birthday and Easter expenses. I also used it to get a certificate for my gas appliances which I needed for my house sale

- My cash spend was the same as last month at £40

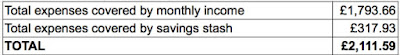

SAVINGS STASH VERSUS MONTHLY INCOME

Here's the split of how my expenses were covered from my Savings Stash (highlighted in yellow above) and from my monthly income:

Savings - Mar 2016

Subtracting my March expenses (excluding expenses covered by the Savings Stash) from my income for the month I can see what I've got left to save into my Savings Stash and Freedom Kitty:

The overall percentage of my income I've been able to save is 50.01%, that feels like a pretty solid savings rate again this month.

As I mentioned last month, the savings rate I'm really interested in is the amount going into the Freedom Kitty which is what will fund me in the 7 years between becoming financially independent at age 50 and being able to withdraw my personal pension at age 57. At 26.47% the Freedom Kitty rate is lower than I achieved last month (31.46%), but I'm not going to worry about it too much because I was only £50 short of my £1,000 monthly target for savings into my Freedom Kitty.

My Savings Stash usage looks like this for the month:

As well as the usual money in and out, I decided to shift some of my emergency funds from the Savings Stash to my Freedom Kitty so that I could take full advantage of my ISA allowance for the 2015/2016 tax year, you can see this reflected in the table as the £1,123 out.

Well, after my second month of tracking my income, expenses and savings rate I'm feeling pretty pleased with how things are going. On the whole I think I've managed to keep my expenses reasonably low (low for my normal spend rate anyway) and now that I have made a plan for how to get to FI it's really nice to document how I'm getting on with achieving it on this blog.

Did you have any last minute dashes to shift money around for the tax year end? Did you fill your ISA allowance? This is the very first year I've ever filled my ISA allowance and I have to say, it feels good!

I've started reading your blog and I'm very impressed.

ReplyDeleteKeep up the good work!

Hello!

DeleteThanks so much for your kind comment, I really appreciate it.

OR

That is a healthy savings rate you have there OR.

ReplyDeleteYou seem to have a good balance between saving and still enjoying life. It is sometimes a difficult thing to get right. I know for me I would save everything I can while my wife is a live for today person. Between us we balance each other very well and for us at least we are happy with our lives, which at the end of the day is what matters.

As far as the ISA is concerned I simply divide the yearly ISA allocation into 12 and pay that in each month. That means at the end of the financial year both of our ISA allocations have been filled. It sounds a bit boring but we buy into the markets each month irrespective of where they are and to date it has worked out okay for us.

Good luck with your saving.

Richard

Hi Richard,

DeleteThanks for your comments. Given that I've only recently started my FI journey in earnest I'm feeling pretty happy with the 50% overall rate, though I'm going to try to increase the amount that goes into the Freedom Kitty if I can. I think the idea of paying in 12 equal payments into the ISA to max it out is really good (not boring - clever!), and something I aspire to. However I'm not confident yet that I'll have enough each month to manage this amount - I'm investing a little in some side-hustles at the moment which is likely to mean I have a bit less in the short-term. I will keep trying though!

I do think you've hit the nail on the head with your observation about my balance between saving and enjoying life, I don't think I'll ever be someone who will save everything at the detriment of doing stuff in the now. I don't spend carelessly, but I will still make sure that I can go out and have dinners with family and friends, and do fun things if they pop up, because after all, life is for living!

OR

Hey OR

ReplyDeleteGreat savings rate at 50% - well done, especially as you have just started your FI journey!

Enjoyment and relationships can't be neglected in the pursuit of FI - I mean who's to say your friends who you've shunned because you didn't want to eat out with will still want to be your friend when you're FI and have a load of time on your hands?

I note that in your charity section, you donate to a hospital lottery. I used to do that and given that I've started to donate more to charity, thought I'd do the same. Unfortunately, our local hospice no longer runs such a lotto so I've just joined the one run by Age UK. Thanks for the reminder!

Hey Weenie,

DeleteThanks for your encouragement. I've been doing the hospice lotto for about 4 years now, and in that time I've had one small win of about £5! It's nice to know that it's a lotto with a chance of winning something, but it's even better to know that you're supporting a good cause. I didn't know that Age UK run one. I also have a few small monthly direct debits set-up to various charities I've found over the years that mean something to me.

I read your post about donating to charity - it's a difficult one knowing how much to donate when at the same time you're trying to save as much as possible for investing toward FI. I think the best thing to do is just do something on a regular basis that you feel comfortable with - then you can always up the ante in the future either in terms of giving your time or more money if you find yourself in a position where you have more to give.

OR